Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures at the bottom of every page.

Something that most people reading this article will probably know is that every quarter, the Chase Freedom Flex℠ credit card and the Chase Freedom credit card (not open to new applicants) offer bonus points for spending in select categories to cardholders who register their cards after the quarterly categories have been announced.

What some people may not know, however, is that it’s sometimes possible to earn these bonus points even if you forget to register your Freedom card before you use it to pay for spending made in one or more of the bonus categories.

Here’s how this can work…

Despite the fact that I wrote an article about this quarter’s Freedom bonus categories in which I included a link to the quarterly registration page, I somehow forgot to register my own Freedom card for the Q1 2023 promotion. Apparently I’m not as smart as I like to think I am!

Anyway…

Towards the end of January, it occurred to me that I hadn’t made a start on maximizing this quarter’s Freedom card bonuses (offered on up to $1,500 of combined spending at grocery stores, at Target and at fitness clubs and gyms) and because I didn’t realize that I had forgotten to register for the promotion, I started using my Freedom card every time I visited a grocery store.

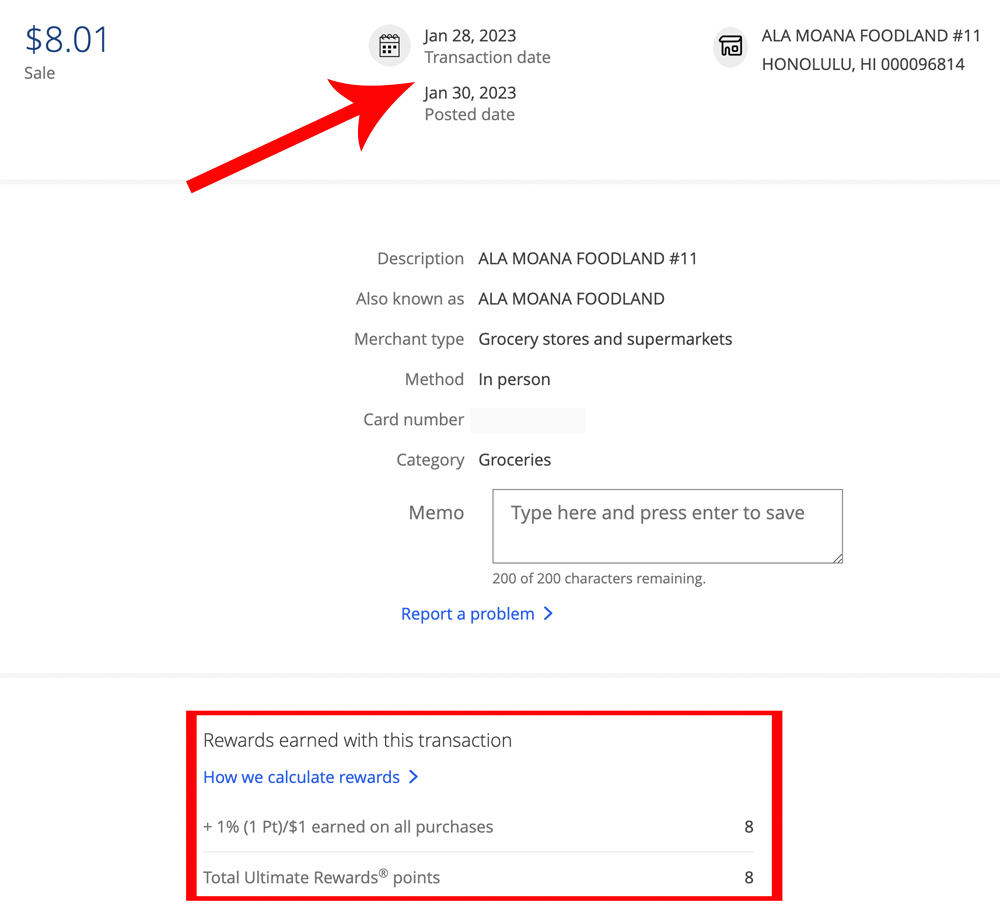

Fortuitously, a couple of days later, I happened to be checking my online account and noticed that a small charge at a grocery store hadn’t earned me any bonus points – note the date of the transaction.

I was tempted to assume that this was an error on the part of Chase, but I was realistic enough to realize that this was a moment to apply Occam’s Razor and that it was far more likely that the error was mine and that my card wasn’t registered for the Q1 bonuses.

I used the link in my own article (from December!) to head over to the bonus registration page and went through the super-simple registration process which (very quickly) proved that up until that point, my card had not been registered for the Q1 promotion.

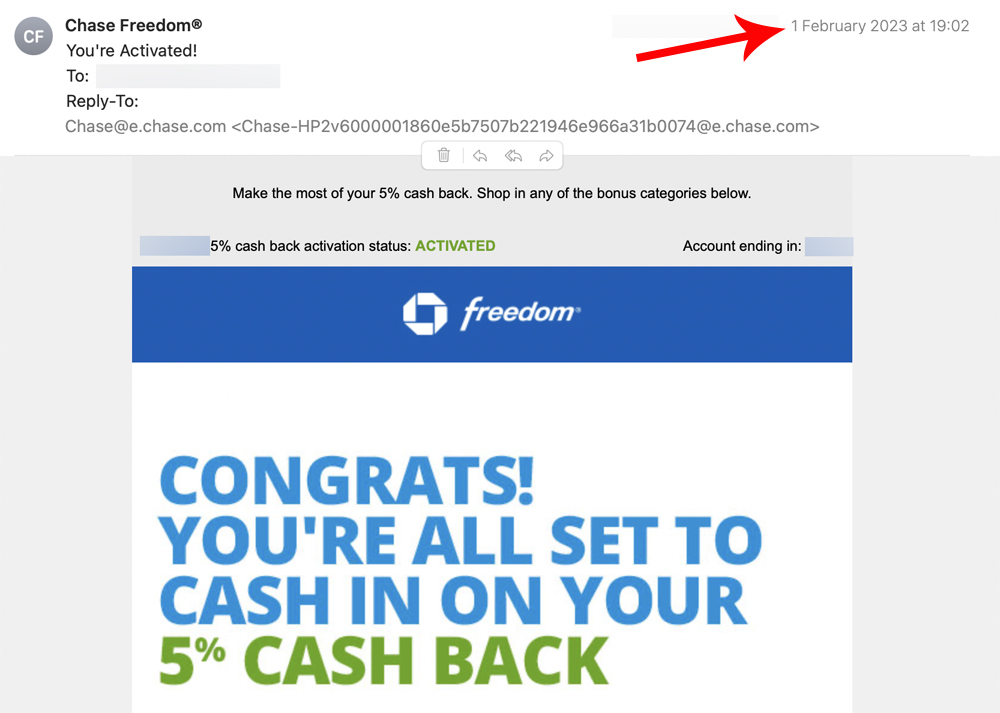

Shortly after registration was complete, Chase sent me an email confirmation – note the date on the email.

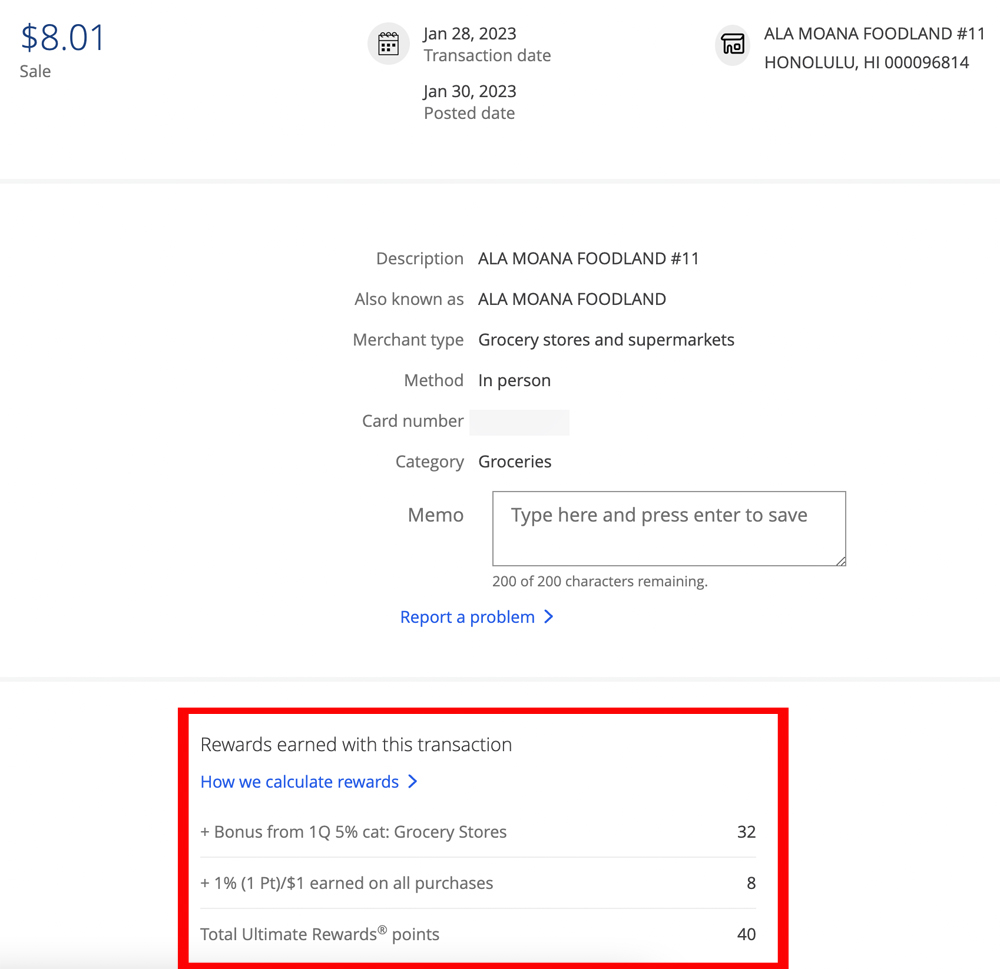

At this point I had no real expectation of getting the bonus points that I had missed out on, but because I was curious to see what would now happen, I checked my Chase account a couple of days later and found this:

The grocery store transaction which a few days ago had only earned me 8 Ultimate Rewards Points, was now earning me 40 Ultimate rewards Points.

Chase had boosted my earnings retroactively.

I had no idea that this was something that Chase is happy to do and while I suspect that points will only be added retroactively for a billing period that has yet to close (if my statement had closed after the $8.01 transaction had posted and before I had registered, I doubt Chase would have given me the bonus points), this proves that it’s not always too late to earn some bonus points even if it may seem like it is.

Note: You have to register by 14 March 2023 to be eligible for the 1Q 2023 Freedom bonuses.

Bottom line

Apparently, in some circumstances Chase will credit cardholders retroactively with bonus points from the Freedom quarterly promotions even if the spending occurs before a cardholder has registered their card.

Retroactive credits are probably unlikely for completed billing cycles, but the fact that there’s any kind of opportunity to earn points retroactively is generous on Chase’s part.

Did you know that this was something that Chase is happy to do?

![Chase is launching new spending bonuses for 2Q 2023 [Targeted]](jpg/chase-741-1-1-80x60.jpg)

![Save $200 on select Air New Zealand bookings with Amex [Targeted]](jpg/air-new-zealand-741-356x220.jpg)

Do you mean retroactively?

I’m not sure. I checked the definitions online before I wrote this and was still unsure which word was the one I should be using so I picked one and ran with it.